Fintech Data Science merges financial expertise with advanced analytical techniques. It optimizes financial services, drives innovation, and enhances customer experience.

Fintech Data Science is revolutionizing the finance industry by employing powerful data analytics and machine learning. Companies are leveraging these technologies to gain insights that drive smart decision-making and automate processes. This domain requires professionals who are adept in statistics, programming, and domain knowledge of finance to extract actionable information from complex datasets.

With the evolution of big data, Fintech firms are now better equipped to tailor products, assess risk, detect fraud, and offer personalized financial advice to customers. The surge in its adoption reflects its potential for empowering financial institutions to remain competitive in a rapidly changing digital economy. As data becomes more integral to financial services, the synergy between financial technology and data science stands as a cornerstone for innovation and efficiency in the industry.

Credit: etinsights.et-edge.com

Role Of Data Science In Fintech

Data science propels fintech innovations by extracting valuable insights from complex financial datasets. Advanced analytics and predictive modeling refine customer experiences and drive informed decision-making in fintech.

Unraveling The Impact Of Data Science In Fintech

The fintech industry has been revolutionized by data science, an instrumental force driving innovation and efficiency. By leveraging massive data sets, fintech companies are not only able to predict market trends but also tailor their services to individual customer needs, something traditional financial institutions may struggle with.

Data-driven Decision Making

- Predictive Analytics: Predictive models in fintech utilize historical data to forecast future events, such as credit risk evaluation or market movements. These insights enable more informed and strategic business decisions.

- Customer Segmentation: By analyzing consumer data, fintech firms can segment customers into distinct groups for targeted marketing, product offerings, and personalized financial advice.

- Algorithmic Trading: Algorithms developed through data science can execute trades at optimal times based on market data analysis, resulting in increased profitability and reduced transaction costs.

Enhancing Customer Experience

Understanding customers is at the heart of fintech innovation. Data science arms fintech companies with a detailed comprehension of consumer behavior, enabling personalized interactions.

- Personalization: Using machine learning, fintech services can provide personalized recommendations, such as investment options or savings plans, that resonate with individual user preferences and financial goals.

- Fraud Detection: By employing advanced algorithms, fintech companies can swiftly identify suspicious activities, thereby ensuring customer accounts remain secure and building trust.

- Chatbots and Virtual Assistants: Data science enables the creation of sophisticated chatbots that offer fast, relevant responses, streamlining customer service and support.

Optimizing Operational Efficiency

The infusion of data science not only elevates external services but also amplifies internal operational proficiency within fintech firms.

- Risk Management: Data science equips fintech with tools to assess and mitigate risks by analyzing patterns and trends, which is essential for regulatory compliance and financial stability.

- Process Automation: Through the application of data science, repetitive and manual tasks can be automated, leading to improved efficiency and cost reduction.

- Credit Scoring: New data-driven credit models have emerged, providing more accurate and inclusive assessments of borrowers’ creditworthiness than traditional credit scoring systems.

Spearheading Product Development

The intersection of fintech and data science results in the creation of innovative financial products that meet the evolving demands of the market.

- Innovative Financial Products: Data analysis identifies market gaps and customer needs, guiding fintech firms in developing cutting-edge financial products.

- Customizable Services: Fintech can use data science to create flexible and customizable financial services that adapt to real-time user data and feedback.

- Market Sentiment Analysis: Fintech companies leverage sentiment analysis to gauge public opinion on financial products, which can be vital in product refinement and tailored communication strategies.

Ensuring Regulatory And Security Compliance

Data science provides fintech firms with robust frameworks to navigate the complex maze of financial regulations and security mandates.

- Regulatory Compliance: Leveraging data science, fintech companies can automate regulatory reporting, making compliance more efficient and accurate.

- Anomaly Detection: Advanced data science methodologies help in monitoring transactional data to spot anomalies, leading to proactive fraud prevention and enhanced security measures.

Fostering Innovative Collaboration

Finally, data science acts as a bridge, connecting fintech companies with various sectors such as technology, retail, and e-commerce, paving the way for interdisciplinary collaborations that enrich the fintech ecosystem.

- Strategic Partnerships: Data insights facilitate strategic partnerships by identifying synergies between fintech and various industries.

- Cross-Industry Data Integration: Integrating data from multiple sectors enhances the predictive power and performance of fintech models, leading to more sophisticated financial solutions.

Key Components Of Fintech Data Science

Credit: pwc.co.uk

Fintech Data Science hinges on robust algorithms and predictive analytics. Key components encompass machine learning models and big data processing, driving innovation in financial services. These elements aid in tailoring customer experiences, risk management, and real-time decision-making.

Emerging technologies and innovative methodologies are reshaping the world of finance. Data science stands at the forefront of this change, especially within the fintech sector. It underpins the algorithms and analytics that power everything from predictive modeling to customer personalization.

Understanding the key components of fintech data science is vital for anyone looking to grasp how data is driving the evolution of financial services.

Machine Learning Algorithms

At the heart of fintech data science lies the power of machine learning algorithms. These advanced computational processes enable financial applications to learn from and make predictions on data. Take, for instance:

- Predictive analytics: By harnessing historical data, algorithms can forecast future trends and consumer behavior.

- Fraud detection: Machine learning models are trained to spot anomalies that could indicate fraudulent activity, thus protecting both the service provider and the customers.

Big Data Analytics

Data science in fintech doesn’t just deal with structured data from transaction records. It encompasses vast arrays of unstructured data as well, collectively known as big data. Here’s how fintech leverages big data analytics:

- Real-time processing: Financial institutions use big data tools to analyze transactions as they happen, enabling instant decision-making.

- Customer insights: Analytics help in understanding customer preferences and behavior, which is crucial for personalized services.

Data Security And Privacy

Without robust security and respect for privacy, the trust that underpins financial transactions would crumble. In the realm of fintech data science, these concerns take center stage:

- Encryption techniques: Protect sensitive information even if a breach occurs.

- Regulatory compliance: Data science works within the framework of laws like GDPR to ensure personal data is handled appropriately.

Cloud Computing

The scalability and flexibility that cloud computing offers make it an integral component of fintech data science. Let’s delve into the specifics:

- Resource management: Cloud solutions provide the necessary resources on-demand, which is crucial for handling large-scale data operations.

- Cost-effectiveness: By using cloud services, fintech firms can reduce expenses on IT infrastructure and focus resources on development and innovation.

User Experience Optimization

Focusing on the end-user is crucial for the success of any fintech solution. Data science contributes significantly to enhancing the user experience by:

- Personalization: Algorithms analyze user data to provide tailored financial advice, product recommendations, and service alerts.

- Interface design: Data-driven A/B testing informs user interface improvements, making apps more intuitive and easy to use.

In a rapidly evolving financial landscape, the pillars of fintech data science provide the foundation for innovation. By understanding and implementing these components, fintech companies can offer secure, personalized, and highly efficient services to their users. Such strategies not only foster customer loyalty and trust but also propel the industry towards a more data-driven future.

Challenges And Opportunities In Fintech Data Science

Credit: softwebsolutions.com

Navigating the dynamic landscape of Fintech Data Science presents a unique set of hurdles, such as safeguarding sensitive information amid intensifying cyber threats. Simultaneously, the sector offers vast potential for innovation through the application of AI and machine learning to improve financial services.

In recent years, the marriage of finance and technology has birthed the dynamic field of Fintech, where Data Science plays a central role in driving innovations and solutions. Embarking on the journey through Fintech Data Science reveals a landscape filled with both difficult terrain and fertile ground.

Let’s explore these dual aspects and uncover how they shape the industry.

Data Quality And Cleaning:

The foundation of Data Science in Fintech is data itself; nevertheless, the data rarely comes in a pristine form, presenting one of the first hurdles for professionals:

- The complexity of Financial Data: The intricate nature of financial data often includes unstructured formats, making it challenging to harness and process efficiently.

- Prevalence of Outliers and Noise: Fintech datasets can succumb to anomalies and irrelevant information, obscuring valuable insights and complicating analysis.

- Regulatory Constraints: With stringent regulations governing financial data, ensuring compliance while cleaning and processing data can be an arduous process.

Real-time Processing And Analysis:

The fast-paced world of finance doesn’t wait. Being able to make informed decisions swiftly is crucial and poses both a challenge and an opportunity:

Being adept at real-time processing means leveraging data as it streams, providing Fintech firms with the edge to make effective, instantaneous decisions. The implementation of strategies like algorithmic trading is founded on this immediate insight generation, capitalizing on momentary market opportunities.

Enhanced Customer Experience Through Personalization:

Data Science unravels personalized interactions by meticulously segmenting customer data:

- Targeted Financial Products: Creating customized financial solutions for individuals based on their historical data and behavior patterns.

- Personalized Customer Service: Utilizing chatbots and AI-driven support tailored to each customer’s unique needs and preferences.

- Predictive Behavior Modeling: Establishing models to predict customer needs and preferences, driving higher engagement and satisfaction.

Security And Fraud Detection:

In an industry where security is paramount, Data Science shines as the guardian of financial sanctuaries:

The prowess of predictive analytics in detecting fraudulent patterns and anomaly detection systems in safeguarding against security breaches is testimony to the expansive capabilities of Data Science. It not only identifies possible threats but also reduces false positives, refining the firewall that protects both the service providers and their clients.

Leveraging Unstructured Data For Insights:

Fintech is about keeping an eye on the future, and unstructured data offers a goldmine of opportunities:

Diving deep into text analytics, sentiment analysis, and social media data, Data Science professionals uncover trends and sentiments that drive strategic financial decisions. This exploration of unconventional data sources can reveal market directions and customer inclinations, fueling innovation in product offerings and service enhancements.

Navigating the nuanced realm of Fintech Data Science encapsulates a unique blend of technical prowess and innovative thinking. With meticulous attention to detail and a forward-looking attitude, the challenges present themselves as stepping stones to greater achievements, paving the path to unprecedented opportunities in the financial landscape.

Successful Use Cases And Examples

Fintech Data Science has revolutionized financial services through cutting-edge algorithms and predictive analytics. Successful cases include personalized investment platforms and real-time fraud detection systems, showcasing the profound impact of data-driven strategies in finance.

The Rise Of Robo-advisors In Wealth Management

The financial technology landscape is swiftly evolving, and one of the most remarkable success stories is that of robo-advisors. These automated platforms have revolutionized wealth management by providing algorithm-driven advice without the need for human financial planners. Key highlights of this development include:

- Accessibility: : Robo-advisors have democratized financial advice, making wealth management services available to a broader audience with varying investment sizes.

- Cost-Effectiveness: : They offer a lower-cost alternative to traditional advisors, thanks to automation and scaled-down human intervention, thereby reducing fees for users.

- Customization: : Through the use of advanced analytics, robo-advisors can tailor investment portfolios to individual investors’ goals and risk tolerance, providing a personalized experience.

Machine Learning In Fraud Detection

Fraudulent activities can drain significant resources from financial institutions, but data science has become a formidable opponent against such threats. Machine learning models, trained on vast datasets of transactional data, can rapidly identify patterns that suggest fraudulent behavior, leading to real-time prevention mechanisms.

Here’s how machine learning is contributing:

- Real-time Detection: : Machine learning algorithms can process transactions as they occur, flagging suspicious activities instantly and reducing the window for fraud.

- Adaptive Techniques: : As fraudsters evolve their tactics, machine learning models continuously learn and adapt to new fraudulent patterns, maintaining robust defense systems.

- Enhanced Precision: : With the capacity to analyze thousands of data points, these models reduce false positives, thereby improving the accuracy of fraud detection.

Peer-to-peer (p2p) Lending Platforms’ Success

P2P lending has emerged as a successful fintech innovation that connects borrowers with lenders directly, bypassing traditional financial institutions. This model’s success is attributed to several factors:

- Lower Interest Rates: : Without the overhead of banks, P2P lending can often offer more competitive interest rates to borrowers.

- Investment Opportunities: : For individuals looking to invest, P2P platforms provide an avenue to earn higher returns compared to traditional savings accounts.

- Credit Access: : These platforms have expanded credit access to those who might be underserved by conventional banks, thanks to innovative credit scoring models.

The success stories of fintech leveraging data science are a testament to the transformative power of technology in the financial sector. By providing innovative solutions that are accessible, cost-effective, and tailored to individual needs, FinTech is charting a new course for the future of finance.

Whether it’s through enhancing investment strategies with robo-advisors, safeguarding assets with machine learning in fraud detection, or creating new lending pathways with P2P platforms, the synergy between fintech and data science is creating a more inclusive and efficient financial ecosystem.

Future Trends In Fintech Data Science

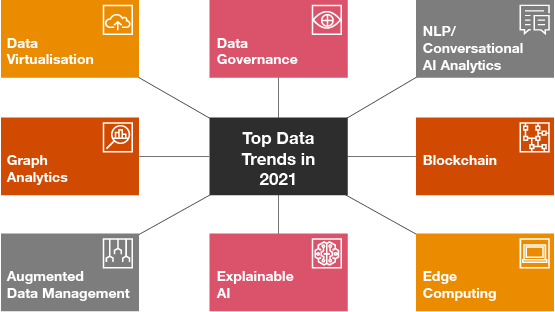

Fintech Data Science is rapidly evolving, with future trends indicating a surge in AI-driven financial models. Anticipate a blend of predictive analytics and blockchain technology to revolutionize secure, personalized finance solutions.

The Integration Of AI and ML in Fintech Solutions

With the ever-evolving landscape of financial technology, artificial intelligence (AI) and machine learning (ML) are elevating fintech to unprecedented heights. These technologies are now essential in analyzing massive volumes of data, predicting trends, and automating complex financial processes. The precision and efficiency they bring to fintech data science are setting a new standard for personalized customer experiences and robust security measures.

Blockchain’s Expanding Role In Financial Data Security

- Decentralized Data Management: Blockchain’s decentralized nature provides a robust layer of security, distributing data across a network to prevent fraud and unauthorized access.

- Enhanced Transparency: Transactions recorded on a blockchain offer unmatched transparency, aiding in the meticulous tracking of financial activities and reducing the scope of discrepancies.

Quantum Computing’s Impact On Data Processing Speeds

The introduction of quantum computing promises to revolutionize data processing within fintech. By leveraging the principles of quantum mechanics, these advanced systems can process complex datasets at speeds unattainable by traditional computers. This leap forward can lead to near-instantaneous financial assessments and real-time decision-making, transforming the way financial analytics are conducted.

The Growth Of Predictive Analytics In Customer Service

- Personalized Financial Advice: Fintech firms are using predictive analytics to offer highly personalized financial guidance, tailoring services to each customer’s unique profile.

- Anticipatory Problem-Solving: By predicting potential issues before they arise, fintech companies can proactively address customer concerns, enhancing satisfaction and loyalty.

Surge In Demand For Data Science Professionals

With data science integrating deeper into fintech operations, there is a soaring demand for skilled professionals who can navigate this complex terrain. More educational and career opportunities are emerging as the industry seeks individuals proficient in advanced analytics, AI algorithms, and financial principles.

This trend indicates a bright future for those aspiring to merge their passion for data with the dynamic world of finance.

Emphasis On Ethical AI and Bias Reduction

- Fairness in AI Algorithms: There is a growing commitment among fintech firms to develop AI systems that make fair and impartial decisions, combating built-in biases.

- Regulations for Ethical AI: Governments and financial authorities are expected to introduce guidelines ensuring that AI operates transparently and ethically within the fintech sector.

The future of fintech data science is one filled with innovation, challenges, and opportunities. As technology continues to advance, the integration of sophisticated data analysis tools will undoubtedly redefine the financial landscape. The key to success in this digital age lies in the sector’s ability to harness these trends responsibly while delivering exceptional services to customers around the world.

Ethical Considerations And Responsible Use Of Fintech Data

Ethical considerations in Fintech Data Science ensure the responsible handling and analysis of financial data. Fintech professionals must prioritize data privacy and consumer protection while leveraging technology to innovate.

The intersection of finance and technology has ushered in an era of unprecedented convenience and efficiency. Fintech’s rapid growth, however, brings with it a crucial responsibility to address the ethical dimensions of data usage. The way we treat, analyze, and protect customer data falls under intense scrutiny, and for good reason.

Ethical Data Collection Practices

Underpinning the trust between consumers and fintech companies is the assurance that data collection methods honor user privacy and consent.

- Transparency: Fintech firms must clearly communicate what data is being collected and for what purpose. This includes straightforward privacy policies free from obfuscation.

- Consent: Users should have full control over their data, with easy-to-understand options to opt-in or opt-out of data collection at any time.

Avoiding Data Bias And Discrimination

With algorithms playing a pivotal role in fintech solutions, ensuring they make impartial decisions is a non-negotiable ethical tenet.

- Bias detection: Regular audits are essential to identify and rectify any biases that these algorithms might have learned from historical data.

- Promoting fairness: Introducing diverse datasets and considering ethical implications during algorithm development stages can mitigate risks of discrimination.

Safeguarding Data Privacy And Security

The storage and handling of sensitive financial data carry enormous risks, necessitating robust security protocols.

In the fintech arena, data breaches are not just disruptive – they corrode the trust that customers place in digital platforms. Adopting state-of-the-art encryption methods and continually updating security measures shield confidential information from unwelcome breaches.

Responsible Data Sharing

Open banking initiatives and API integrations have made data sharing a focal point for innovation, raising important questions about data custodianship.

- Partnerships: Collaborations between fintech firms must prioritize customer privacy, involving only necessary data exchanges that serve to enhance user experience.

- Regulatory compliance: Staying abreast of and complying with international data protection laws ensures that customer data isn’t exploited in cross-border data transfers.

User Empowerment And Control

Empowering users to manage their personal data reinforces the core values of respect and customer-centric service.

As fintech platforms evolve, providing clear mechanisms for users to access, understand, and manage their data builds confidence and loyalty. Options to correct and delete personal information further consolidate users’ control over their digital footprints.

Accountability And Reporting

Transparent reporting measures act as a powerful check on the responsible use of data.

- Incident reporting: In the event of a data-related incident, swift public acknowledgment coupled with a remediation plan reflects a commitment to accountability.

- Continuous improvement: Regular reviews of data practices and incorporating feedback contribute to refining ethical standards within fintech platforms.

By prioritizing ethical considerations and championing the responsible use of data, fintech companies not only ensure compliance with evolving regulations but also strengthen the overall ecosystem of trust that underpins financial transactions. The deliberate and thoughtful handling of user data not only fosters loyalty but sets a precedent for the entire industry, carving out a future where technology harmonizes with ethical principles for mutual benefit.

Frequently Asked Questions Of Fintech Data Science

What Is A Fintech Data Scientist?

A fintech data scientist analyzes complex financial data using statistical and machine learning techniques to drive innovation and strategy in financial services.

What Is The Salary Of Data Scientist In Fintech?

A data scientist in fintech typically earns between $70,000 and $130,000 annually, with variations based on experience and location.

What Does A Data Analyst In Fintech Do?

A fintech data analyst examines financial data to identify trends, develop business strategies, and enhance decision-making. They create models, predict outcomes, and provide data-driven recommendations to optimize financial services and products.

What Is The Role Of Data In Fintech?

Data in fintech drives personalized services, enhances security, and informs decision-making. It supports risk assessment, improves customer experiences, and fuels innovative financial products. Data analytics is key for competitive fintech strategies.

What Is Fintech Data Science?

Fintech Data Science refers to the application of data analytics, machine learning, and statistical models to solve financial technology problems, optimize services, and innovate in the finance industry.

How Does Data Science Impact Fintech?

Data science drives personalized customer experiences, fraud detection, risk management, and algorithmic trading within the Fintech sector, leading to smarter financial solutions.

What Skills Are Required In Fintech Data Science?

Key skills include statistical analysis, machine learning, programming (Python or R), big data technologies, and knowledge of financial markets and instruments.

Why Is Machine Learning Important In Fintech?

Machine learning enables automatic learning from data patterns, which improves decision-making, fraud prevention, and customer service in financial technology operations.

How Does Ai Transform Fintech Services?

AI reshapes Fintech by providing intelligent chatbots for customer service, enhancing personal financial management, and streamlining regulatory compliance with smart algorithms.

What Is Algorithmic Trading In Fintech?

Algorithmic trading in Fintech involves using computer algorithms to execute trades at optimal times, often based on complex models and high-frequency data analysis.

Conclusion

Navigating the fintech landscape requires a keen grasp of data science. As we’ve explored, this powerful combination drives innovation and efficiency. Fintech firms embracing data science stand at the vanguard of financial services. They’re reshaping how we interact with money.

Embrace these insights and stay ahead in this digital revolution.